There’s been a boom in merger and acquisition (M&A) activity in the fire and security world over the last decade. Fire protection and security proved to be largely recession-proof and pandemic-resistant. At the onset of the COVID-19 pandemic, fire protection was quickly deemed essential work, and recurring inspections continued on. Business as usual. Investors took note, and the industry became increasingly attractive.

First off, fire and security businesses–depending on the specific trade and services they provide–are often built on a recurring service model. Inspections take place at various frequencies, ranging from weekly all the way to a five-year cycle.

Additionally, fire protection is a “codified” industry, meaning the business is based on regulations at the local, state, and federal levels. Businesses have to conduct inspections and manage deficiencies to remain in compliance and ensure their systems are working properly. There’s always demand for fire protection services because fire protection is mandated by law.

Investors have noticed this combination is a winning one. And we’ve seen the results at every level of our industry. In 2022, after the pandemic, Chubb Fire & Security was purchased by APi Group for over $3 billion. But these deals don’t occur only at the enterprise level. Sciens Building Solutions, a mid-sized fire protection business, was acquired by Carlyle Group in 2021. And small business acquisitions happen, too. Northern Lakes Capital acquired five local fire protection businesses and consolidated them into Guardian Fire Services, bridging geographic and trade gaps in the process.

Long story short, M&A activity is happening–and happening rapidly—with companies of virtually every size across the industry.

If you want to attract investors to your business, an in-depth look at your tech stack is a crucial step. Potential partners or acquirers will be looking at your tech stack and the data you’re able to glean from it. It’s better to be prepared ahead of time with clean and effective technology platforms so you’re ready if and when an investor comes knocking.

What’s a Tech Stack & Why Does It Matter?

“Tech stack” can be a buzzword these days. But what do we really mean by it? And why does your business’s tech stack matter so much, especially in this incredibly active M&A environment?

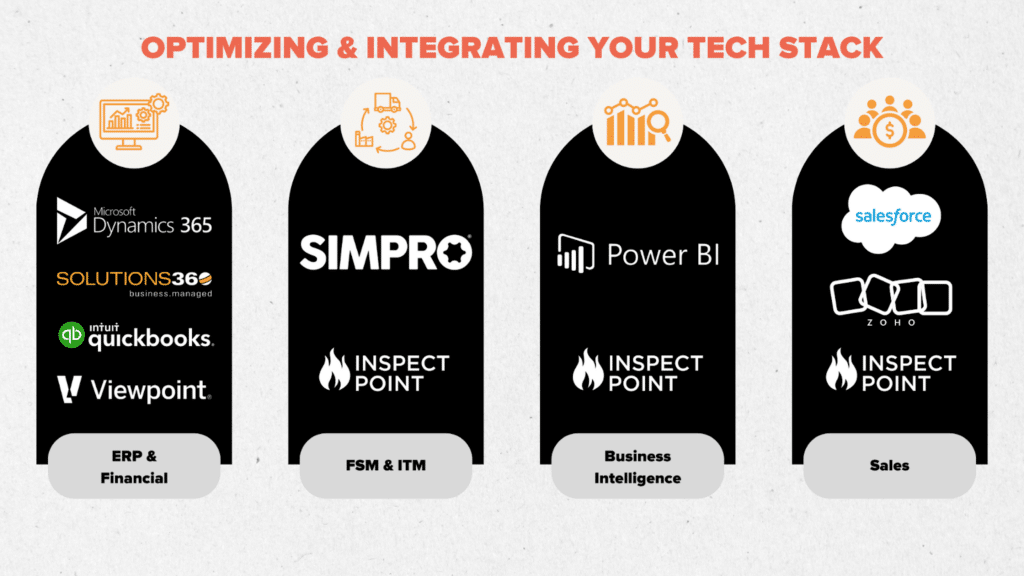

A tech stack is, essentially, the different technology tools you use to conduct business day-to-day. This can include everything from your ERP to accounting, inventory management, and fire and security software like Inspect Point.

Obviously, your tech stack matters because it impacts how you run your business. But it also impacts the level of visibility you have into your operations. Old-fashioned systems like pen and paper or basic spreadsheets can’t synthesize or optimize your business’s complex, multi-layered data. Your tech stack should include solutions that help you see and understand what’s really going on in your business. Then, you can better inform decisions to help your business grow and drive investor interest—if you’re interested in going the M&A route.

Integrating Your Tech Stack

We’re seeing integration across the board in fire and security tech. Having a fully integrated tech stack used to be difficult, if not impossible, to achieve. With systems that work together more efficiently than ever before, open APIs that allow for flexible integration, and tech solutions for every area of business operations, complete and effective integration is now attainable for many organizations.

Every technology platform you use–from your customer relationships management (CRM) platform to your field service management (FSM) platform—should, as much as possible, integrate with your financial platform and/or enterprise resource planning (ERP) system. Financial information is front and center for understanding and interpreting business performance. Integrating operational, inventory, and other key data points helps you build a more complete picture of how you’re doing, all while keeping financial performance at the center.

Assessing Your Tech Stack

There are a few key questions you want to ask when looking at your tech stack and determining if you’ve optimized your systems to best support your business and maintain high visibility.

- What technology tools does your business currently use? And for what processes?

- Do your technology tools integrate with your financial platform?

- Do your technology tools integrate with each other? For example, does your CRM integrate with your FSM platform?

- Are things like customer payments integrated into your processes?

- What compliance solutions do you need to provide for your customers?

Ultimately, take stock of what technology platforms your business uses, what they do, and how they interact with one another. Then, determine if further integration is necessary to streamline operations and improve access to critical data insights.

The Pros & Cons of Full-Scale Integration

An integrated tech stack can do great things for your business. When the different technologies you use to run your business work together, it means less manual work for you and your team. Plus, you get a deeper look into key data that can help you run your business better. Your company’s value immediately goes up when you have an integrated system simply because you have access to clear, concise data about your company’s performance.

While having an integrated tech stack increases visibility into your business, drives greater efficiency, and brings new opportunities, getting to the point where your tech stack is successfully integrated isn’t always easy.

Maybe your financial platform doesn’t play well with others. If that’s the case, integration can be difficult. Switching financial platforms is a big lift that requires a significant investment of time, money, and resources. Take time to weigh the costs and benefits when considering such a major change. If you do want to make the switch, you have to consider what solution is best for your business. And, often, integrations cost money–on one platform’s side or both. Are you willing to pay for the costs of integration to reap the benefits?

The Role of Tech Stacks in M&A Activity

Investors want to know the ins and outs of your business: What subset of fire and security are you in? What kind of systems do you service and what kind of customers do you have? Where is your revenue coming from? Are you primarily making money from recurring inspections or from installations? How does your team operate? What drives efficiency and additional revenue?

If you want to attract investors to your business, an in-depth look at your tech stack is a crucial step.

M&A firms are looking at key metrics that indicate the health of your business and how it will continue to grow in the coming years. You’ll have to open up your books in the M&A process so the acquirer can take a serious look at everything going on in your business. And an integrated tech stack makes that process a whole lot easier.

Data isn’t the only thing an integrated tech stack brings to the table for fire and security businesses. Up-to-date, integrated systems that drive operational efficiency instill confidence in potential investors. Conversely, outdated systems that lead to problems—from inefficiency to significant errors and inaccuracies—can cause investors to shy away from your business.

Key Metrics to Look Out For

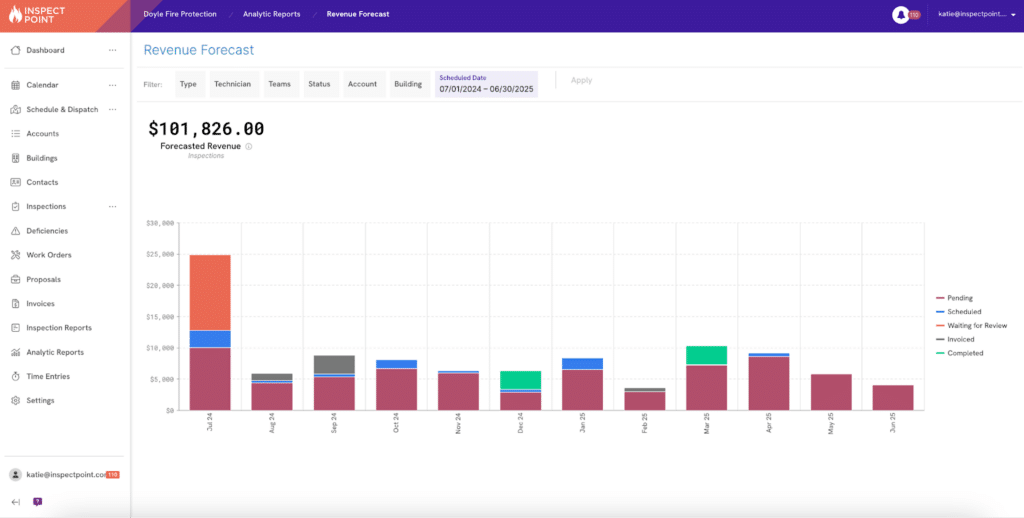

So, your tech stack matters to potential partners or acquirers. However, no one will make an investment without doing their due diligence. Due diligence requires you to provide a whole slew of key metrics that demonstrate the profitability and performance of your business. When you have synthesized data that shows what happens at both a high level down and at a granular level, you can easily provide everything potential investors are looking for. Some of the key data points investors look for from fire protection and security companies include:

- Number of inspections and/or service calls your team completes each day

- Revenue each technician or team member brings in each month or year

- The spread of your business between recurring revenue and installation

- Margin analysis for different sectors within your business (e.g., ITM, service, or install; alarm, security, suppression, or sprinkler)

- Days sales outstanding (DSO), or the number of days it takes to collect cash from your customers

A Success Story

I’ve seen the impact of an integrated tech stack in this active M&A environment firsthand with our customers at Inspect Point. We had a customer with a growth mindset who initially focused solely on sprinkler installations, but they wanted to diversify. They expanded into sprinkler inspections, acquired an extinguisher inspection company, implemented Inspect Point, and grew their recurring revenue stream.

Players in the M&A space took notice and gained interest in their business. The due diligence process was streamlined and made simple because they had an integrated tech stack. Within Inspect Point alone, they had extensive data on their day-to-day operations, revenue, and more. They were able to easily provide the investing company with all the information they needed about revenue sources, recurring revenue, and operational performance to make an informed decision.

Looking Ahead

Currently, we’re in a wave of M&A in the fire and security industry. The tides will eventually change as investing firms acquire more of these businesses. Some employees—technicians or otherwise—will continue working at the acquired firm. Other employees will see the change as an opportunity to start their own endeavors, leading to an increase in small, localized fire and security businesses. We’re not there yet, but we’ll see this cycle of consolidation and fragmentation continue as long as there are fire and security businesses.

An integrated tech stack can be part of proactively addressing the challenges your business faces while supporting your business goals, whether you’re looking for an investor or not.